University of Wisconsin Center for Cooperatives

Research on the Economic Impact of Cooperatives

Farm Credit System

Overview

Absence of rural credit led to the creation of the Farm Credit System (FCS) in the early 1900s. The system is a cooperatively owned government-sponsored entity (GSE) with an explicit mandate to serve agricultural borrowers. Today the system continues to be a dominant source of long-term farm debt, which has grown from 20% of real estate farm debt in 1960 to 40% in 2006 (USDA, 2006). Its consumer base includes farmers, ranchers, producers of aquatic products, agricultural cooperatives, select rural communications and energy companies, rural homeowners, and other eligible entities.

The FCS differs from other financial institutions in that it is a pure lender and finances its agricultural lending through the issuance of financial securities. As of 2007, the FCS accounted for 37% of total farm debt with 42% in real estate and 31% in non-real estate activities. In addition to extending dependable credit, the FCS promotes competition by expanding its financial menu to include services such as consulting, estate planning, record keeping, crop insurance, credit and mortgage life insurance, disability insurance, tax preparation, and cash management. Today private financial institutions also offer financial services to the agricultural sector. Collectively the private sector accounts for 60% of total farm debt, 54% in real estate and 65% in non-real estate debt.

History

Since its inception during the Roosevelt administration, the FCS has undergone several rounds of restructuring. In 1916, the Federal Farm Loan Act established a credit delivery system to the agricultural sector by creating Federal Land Banks (FLBs) in 12 regions of the U.S. These land banks provided funds to regional banks and associations so that they could provide long-term mortgage financing to farmers. During the Great Depression, the Farm Credit Act of 1933 was enacted to bolster agricultural production by funneling short-term credit through 12 Production Credit Associations and 13 Banks for Agricultural Cooperatives. Simultaneously, the Emergency Farm Mortgage Act was mobilized to refund the FLBs as an aid package to farmers facing foreclosures and debt defaults. All credit agencies were consolidated into the Farm Credit Administration in 1987.

Until the 1980s, banks took care of the lending needs of a specific geographic district and the associations operated within a geographic district. The FCS underwent major reorganizing in response to the farm financial crisis of the 1980s. The three main contributing factors for the farm debt crisis of 1985 were falling commodity prices, falling farm land values, and an increasing farm debt-to-asset ratio (Harl, 2005). The impact on the system was significant with record losses, increased accumulation of farm property, and increased amounts of high-risk loans. The Agricultural Act of 1987 brought about significant reorganizing: (1) The Farm Credit Administration (FCA) became an independent arm's length regulator of the FCS with increased enforcement powers; (2) the Farm Credit System Insurance Corporation was created, and (3) the Farm Credit System Financial Assistance Corporation was created with the mandate to re-capitalize FCS institutions in financial distress. Today the FCS is composed of 99 lending associations and banks.

Agriculture in the U.S. is a capital-intensive industry where investments in farmland, machinery, equipment, livestock breeding, storage facilities, etc. require long-term financing. Carrying 40% of the total long-term real estate debt and 37% of total farm debt (as of 2007), the FCS undoubtedly is a prominent player in agricultural credit markets. While commercial banks have established themselves as the main competitors for rural credit, it is hard to make the case that rural credit markets in the U.S. are fully competitive (USDA, 1997). The FCS has access to relatively easy supply of loanable funds borrowed at rates close to the US treasury rate. It is well positioned to absorb the growing demand for agricultural credit given its ability to lend directly to farmers or to farmer cooperatives.

Organizational Structure

All the banks and associations are federally chartered and have tax-exempt status. The income earned by FLBs and FLBAs are exempt from Federal, state, and municipal/local taxes, securities, and other debt obligations are exempt from all but Federal income tax. General oversight for the system is provided by the Farm Credit Administration, which regulates the system and is composed of a presidentially nominated board. The Farm Credit System Insurance Corporation acts as the insurer, and the Farm Credit Council, a trade association, advocates for the system. Organizationally, the FCS is composed of two distinct entities: banks and associations and currently has 94 affiliated lending associations and five banks.

The five banks are AgFirst, AgriBank, Texas, and U.S. AgBank (Farm Credit Banks, FCBs) and CoBank (an Agricultural Credit Bank, ACB). The primary function of the banks is to extend credit to its affiliated associations and, to a lesser extent, extend credit to other eligible financial institutions that carry agricultural credit as part of their loan portfolio. CoBank differs from other banks in the system in that it loans directly to agribusiness cooperatives, rural communication, rural electricity, and rural water and waste, and provides international credit promoting US agricultural commodity exports.

Two types of associations: 85 Agricultural Credit Associations (ACAs) and nine Federal Land Credit Associations (FLCAs) comprise the system. The ACAs extend credit for production and intermediate purposes, agribusiness loans, and rural residential real estate loans, while the FLCAs provide credit only for real estate mortgage lending.

Each bank and association of the Farm Credit System is its own cooperative, and thus has its own member-elected board of directors. Each institution is required to have a nominating committee to select potential candidates and the board must consist of at least 60% member-elected directors. Additional restrictions on board composition include: one outside director (the larger banks and associations require two outside directors), one board member who is a qualified financial expert, and audit and compensation committees.

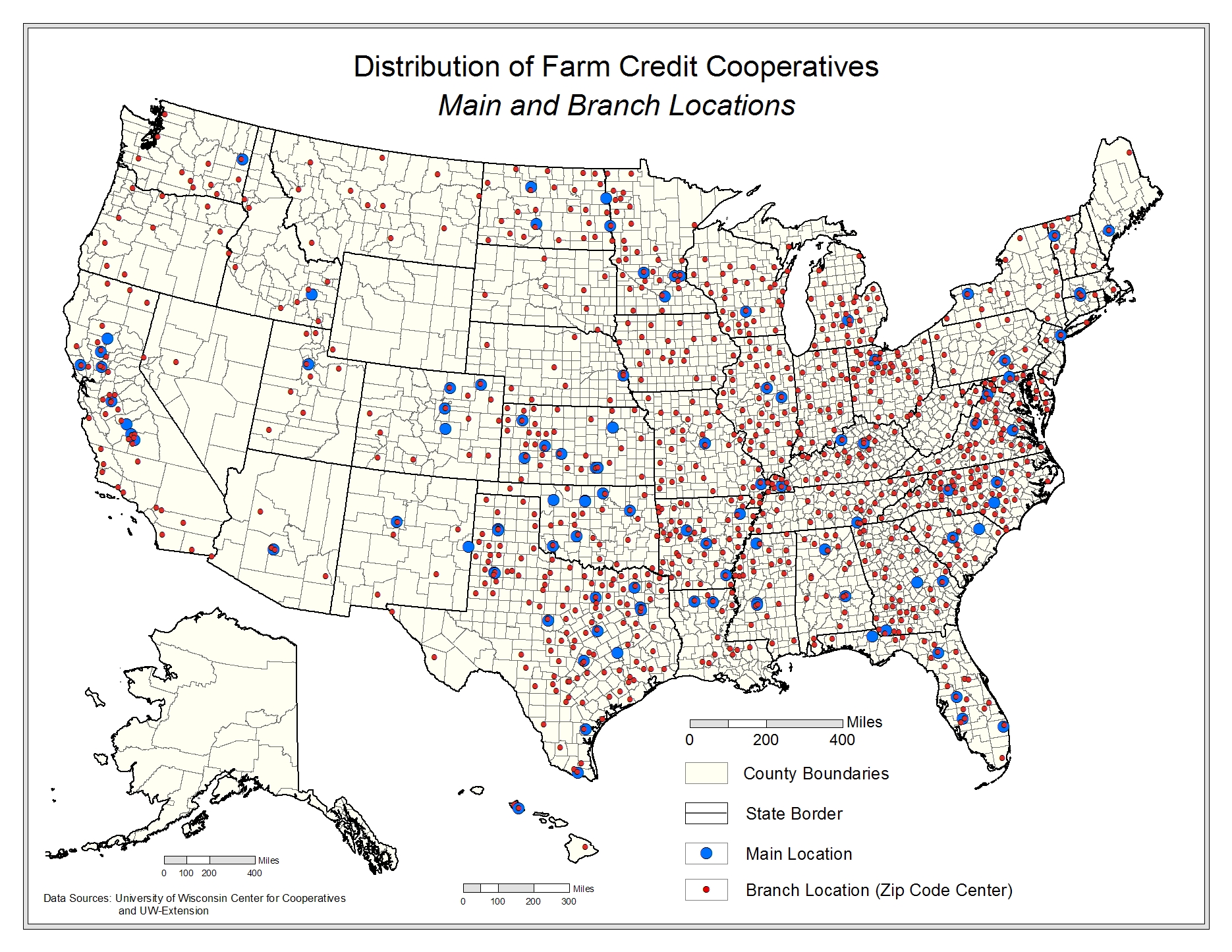

Population Discovery and Data Sources

The Farm Credit Administration maintains quarterly financial data at their website. Employment data and branch-level data was collected by the UWCC. The most recent year for which data are available is 2007. We relied on a combination of primary data (branch, and employment numbers at the branch level) and the FCAs quarterly report data for reporting the summary statistics. The economic impact data was obtained from the 2007 FCA report.

Economic Impacts

Table 4-4 summarizes our data for the farm credit sector. The sector has >$186.4B in assets, close to $12B in sales revenue, and >$1B in wages in benefits pay. There are approximately 400,000 memberships and 15,000 employees. Adding direct and indirect impacts to this activity, Table 4-4.2 shows that farm credit cooperatives account for >$15B in revenue, >13,000 jobs, $2.1B in wages paid, and >$4B in valued-added income.

| Economic Impact | Multiplier | Units | Direct | Indirect | Induced | Total | |

|---|---|---|---|---|---|---|---|

| Revenues | 1.294 | millions $ | 11,884 | 1,540 | 1,958 | 15,382 | |

| Income | 1.756 | 2,446 | 780 | 1,068 | 4,295 | ||

| Wages | 2.078 | 1,009 | 484 | 604 | 2,097 | ||

| Employment | 3.126 | jobs | 11,173 | 9,429 | 14,326 | 34,929 | |