University of Wisconsin Center for Cooperatives

Research on the Economic Impact of Cooperatives

Housing

Overview

A housing cooperative is a corporation that exists to provide housing to its owners, who are the people who live in the cooperative. These people own a share of stock in the cooperative corporation, which owns the land and buildings. The stock gives the owners an exclusive right to occupy a particular dwelling unit and participate in governance of the cooperative.

History

Housing cooperatives and condominiums are both examples of shared interest housing, providing opportunities for people to own units within multi-family buildings. Both models were developed in Europe as an alternative to the rental model. The first cooperative in the U.S. was built in New York City in 1876, 75 years before the first condominiums. Most of the early cooperatives were in luxury buildings, but there were also several affordable housing cooperatives built by labor unions during the period before World War II.

The history of housing is linked closely to Federal, state, and local policies. Although the earliest cooperatives were designed for people with high incomes, a cooperative housing model was developed that encouraged long-term affordability by restricting the appreciation of share value when membership shares are sold. Known as “limited equity cooperatives”, these cooperatives were usually built with some private or public subsidy and required a low initial membership fee. The first significant government program supporting housing cooperative development was the New York Limited Dividend Housing Companies Act of 1927. Thirteen cooperatives were built under this Act. A subsequent New York law, known as the Mitchell-Lama Act, was passed in 1955 and supported the development of 60,000 affordable units, mostly in the 1960s and 1970s. Labor unions and housing activists built 40,000 more units, for a total of 100,000 affordable housing cooperative units in New York state. On a federal level, cooperatives were largely left out of the immediate post-WW II support for affordable housing, but they were included in several important subsidized mortgage programs passed by Congress in the 1960s. By 1995, an estimated 137,000 cooperatively owned affordable units had been built with Federal support in 29 states.

During this period, cooperatives continued to be built for the higher income market, and cooperative owners benefited from Federal tax policies that encouraged home ownership. By 1960, 1% of all multi-family dwellings were cooperatively owned. In 1976, this figure was 2.2%, but by this time every state had a condominium statute and condominiums had replaced cooperatives as the preferred owner-occupied model (Sazama, 2000).

Industry Niche

Owner-occupied multi-family dwellings have become increasingly popular in the U.S., with a 227% increase from 1977-2007. Most of that new development has been in condominiums, which currently represent 5% of the nations’ total housing. Cooperatives are <1% (U.S. Bureau of the Census, 2005).

Although condominiums have dominated the shared interest housing market, cooperative ownership has expanded in several regions and markets. In Minnesota, 74 senior housing cooperatives with 5,600 units have been built since the 1970s, with most of them <10 years old. Their financial structure has been designed to limit asset appreciation and to free up cash assets for the owners by requiring a share price that is <100% of the cost of the unit. As the cooperatives market to seniors, they emphasize strong social networks and self-reliance to a group of people who are concerned about displacement and the loss of control that can accompany aging (Senior Cooperative). Cooperatives for seniors are important also in California, Michigan, and Florida. In Florida, naturally occurring retirement communities are often manufactured home parks. Florida has 88 parks with 5,000 units (Florida Department). In New Hampshire, where the New Hampshire Community Loan Fund has provided loans for conversions from investor-owned to resident-owned parks, 158 parks are resident-owned, providing 41,278 units (New Hampshire, 2007). Conversions have also been significant in Washington, DC, where 2,270 units of affordable rental housing have converted to limited equity cooperatives (Coalition for Nonprofit Housing, 2004).

Organizational Structure

The legal structures of condominiums and cooperatives differ significantly. Condominium owners own their unit as real estate, and own an undivided share in the common areas of the building or complex. Condominiums offer some perceived advantages over cooperatives. Because each unit in a condominium is owned separately, there is less risk of losing the building if one owner defaults. And condominium owners have fewer decisions to make collectively, because only the common areas are owned jointly. On the other hand, since most housing is stratified by price, owners of both cooperatives and condominiums tend to be relatively homogeneous. They usually have a long-term commitment to their housing. These two factors help to mitigate the costs of participating in governance of both cooperative corporations and condominium associations.

Housing cooperatives are governed democratically, with each unit receiving a vote, regardless of size. Most cooperatives elect a board of directors to establish budgets, hire staff and enact policies. Bylaws and policies govern important issues like how membership shares are transferred and membership rules. Cooperatives may require that perspective buyers apply to the board of directors or a membership committee before the sale is completed. These rules and policies are consensual, since they are in the governing documents, rather than dictated by law.

Like all housing, cooperatives are financed through a combination of loans and equity. Cooperative owners will usually contribute some equity toward the purchase of their share, and may also obtain “share loans”, which function like a mortgage loan. In addition, the cooperative corporation may have a mortgage that covers the initial construction cost or remodeling. Cooperative owners pay a share of this mortgage as part of their monthly fee, and the interest is deductible under IRS rules.

Population Discovery and Data Sources

The goal for this sector was to identify every housing cooperative in the U.S. and gather relevant data to determine the economic impact of this sector. We consulted experts in housing cooperatives who advised that we should gather data on property assessments and property taxes paid, but that these values might not be consistent, since assessment and taxing practices vary by municipality.

We conducted two concurrent searches for information. We compiled a list of individual housing cooperatives and we searched for state data on the total number of cooperatives and units. Collecting survey data from housing cooperatives was difficult. From a random sample of 600 cooperatives, we located 300 valid phone numbers, which yielded 32 completed surveys. We sent email requests and advertised the survey on several websites, but had very poor response.

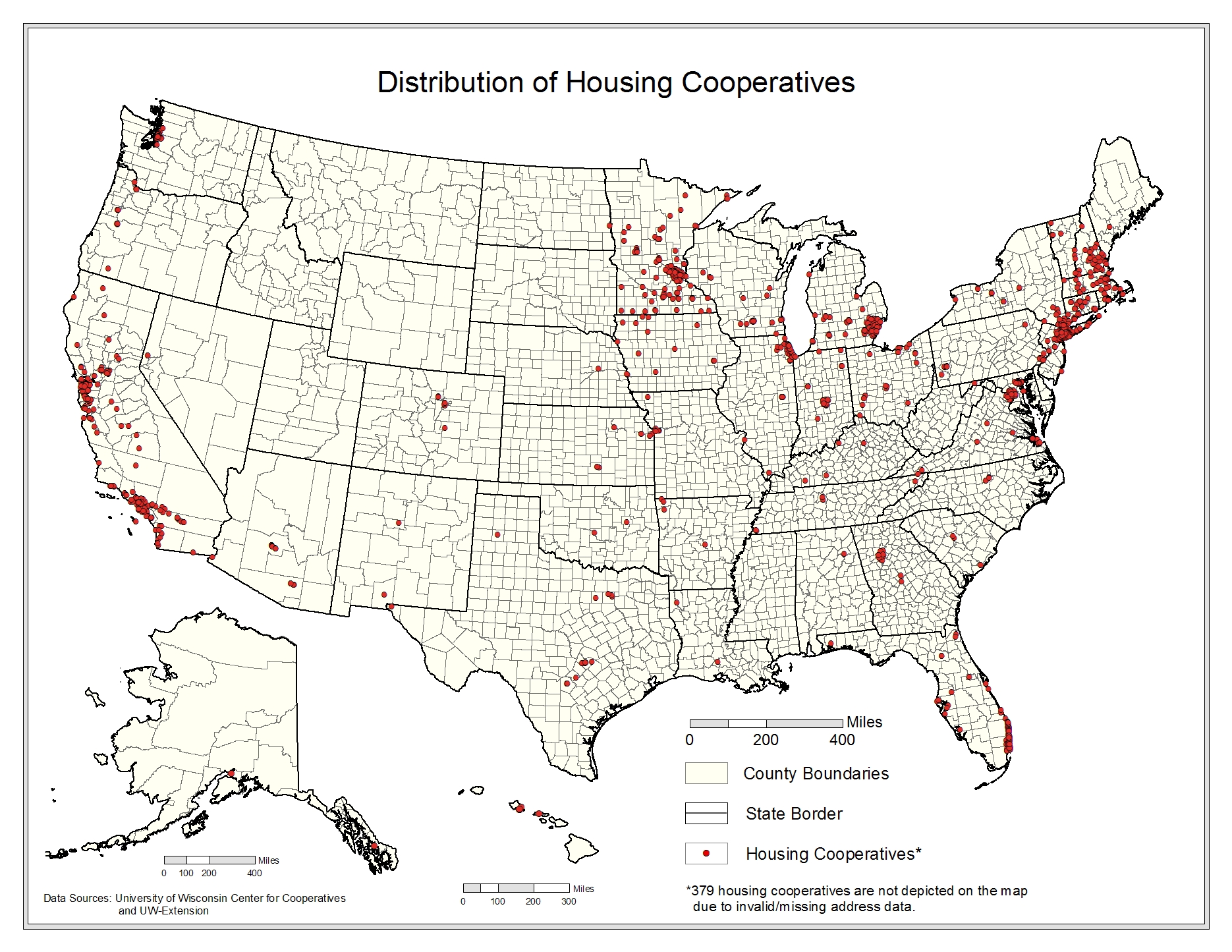

We collected estimates from housing cooperative experts on the distribution of cooperatives across the country. Housing cooperatives developed in regional clusters, with 90% of the cooperatives located in 10 states, plus Washington, DC. We focused on these states, contacting regional housing associations, local experts, and the NCB (formerly National Cooperative Bank) for more detail. Since tax and assessment data is held by local governments, we attempted to contact these organizations, but we were not able to search those listings by cooperative status.

Economic Impacts

Here we provide a brief overview of existing studies that report on the potential impacts of the housing sector. These studies often focus on the economic activity associated with new home construction and redevelopment. An annual Florida study uses a more complex analysis to value residential real estate in the Florida economy, using four impacts. The authors use IMPLAN to measure the impact of construction, plus real estate transactions. In addition, they report on property taxes paid, and the explicit and implicit investment returns for real estate property owners (White, 2006).

The most significant challenge in obtaining similar data for cooperatives is the lack of uniformity in reported property values. Jurisdictions vary in how they value cooperatives for property taxes, and there may be significant differences between the assessed, appraised, and market values may differ significantly. A Florida study used aggregated data at the county and state level, but cooperative housing valuations must be collected by building. This can be challenging. For example, survey respondents might not know if their jurisdiction discounts property tax assessments, or the value of that discount.

Most research on the impact of cooperative housing has focused on the value of the public investment in cooperative affordable housing. Susan Saegert investigated the impact of housing ownership form in >400 multi-family properties that were acquired by NYC for non-payment of taxes and then sold to tenant-owned cooperatives, nonprofits, and private landlords (Saegert, 1998). Her study found that cooperative ownership was positively associated with building quality, better safety and security, and more evidence of prosocial norms. Tenants with higher incomes and better education tended to stay in the cooperative and invest resources in improving their living conditions. Longevity of cooperative tenants was also noted in a Chicago study (Chicago Mutual Housing Network, 2004) and positively associated with community stability. A survey of middle income senior cooperative members had similar results. Members reported improved social contact, life satisfaction, sense of personal safety, and happiness after moving into the cooperative.

A small study in the 1990s used a different approach to analyze the impact of cooperative housing, by examining the effect of resident ownership on the variable aspects of housing costs. Researchers concluded that cooperative ownership significantly reduced operating costs (including marketing, administration, operating, and maintenance costs). Finally, another 1990s survey of members of senior housing cooperatives reported positive health impacts and greater happiness, life satisfaction, social contact, and personal safety from living in a cooperative(Nolan, 2001).